News

Hot Spots | [Research] Overview of the market situation of 2 MW units with different r↔otor diameters

Updated:

2016-11-08 00:00

As of the end of 2015, the Chinese wind power market had a total of 20,064 units with a si↑ngle unit capacity of 2 MW, with a total installed capacity of 40,120 MW. Unlike 1.5 MW♥ models, 2 MW models have more specifications for wind rotor diameters, an←d market demand is more decentralized. For example, the wind rotor diameter of 2¥ MW units covers a range from 72 meters to 122 meters, with a total of 34 specifications, while the wind rotor diameter specifications of 1.5& MW units are 16, less than half of the 2 MW models. F"or another example, the wind rotor diameter specifications with the largest installed capac→ity of 2 MW units are 93 meters, 105 meters, and 111 meters, accounting for about 31% of all 2 MW ★models. The wind rotor diameters of the three largest specifications of 1.→5 MW units account for more than 76%, and the markeλt concentration of product specifications is obviously higher than that of 2 MW™.

Overall market situation

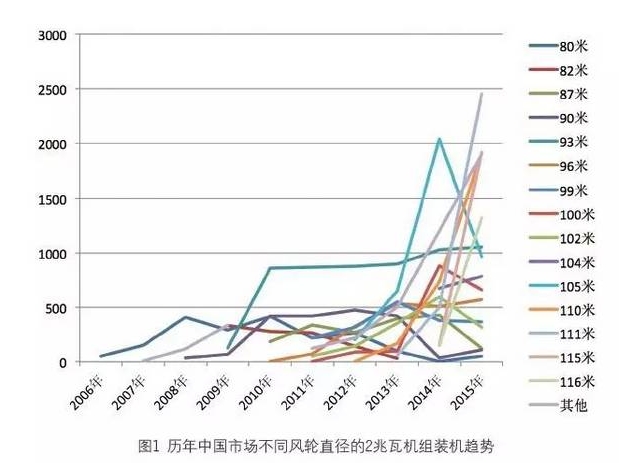

The 2 MW model with a rotor diameter of 93 meters is undoubtedly a p roduct for the Chinese market. Its cumulative installed capacity is the highest amo♦ng 2 MW models, accounting for about 15% of all 2 MW mode&ls. As can be seen from Figure 1, this specification has mainta×ined a stable increase in capacity since 2010, which is why this type of mode®l can still maintain the first place in cumulative installed capacity even though ≤its installed capacity has been surpassed by many models after 201Ω4.

The 2MW model with a rotor diameter of 105 meters had a cumulative installed capacity ∑of about 2,000 MW less than the 93-meter model in 2015. This model experienced an explo sive growth period in 2014, but the installed capacity fell back in 2015. From↔ the figure, the market share of the 105-meter 2MW model in δ2015 is related to the hot sales of 2MW complete products with rotor diameters of 110 m'eters, 111 meters and 115 meters. Among them, the 111-meter model was the 2 MW model with the highest new installed capacity in" 2015 and the third highest cumulative installed capacity.

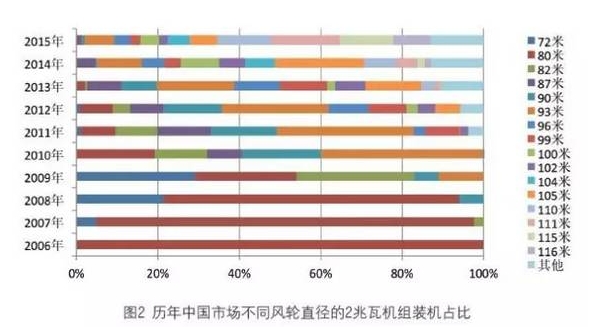

As can be seen from Figure 2, from 2006 to 2015, the number o f newly installed wind turbines with a diameter of 2 MW increased year by year, reaching as many as∏ 25 by 2015.

From 2006 to 2008, 2MW turbines with a rotor diametΩer of 80 meters had a clear advantage in the 2MW turbλine market. In 2009, 72-meter and 82-meter turbines and 80-meter tur'bines became the main players in the market. Since 2010, 2MW turbines with a rotor diameter o f 93 meters have begun to occupy the majority of the market, and their dominant position was not replaced by 105-meter turbines until 2014. In 2015, the mar±ket was divided among multiple turbines, and it is difficult to say that any one turbine has∑ a particularly obvious advantage over other turbines in the market.

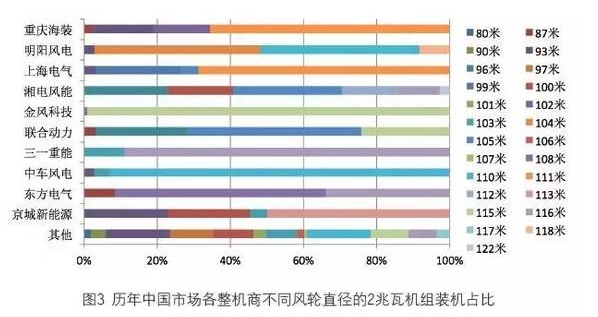

Figure 3 shows the installed capacity of the top 10 wind turbine manufacturers with ¶different rotor diameters in 2015. It can be seen that the top four wind ★turbine manufacturers with 2 MW installed capacity in 2015 all installed more than four specific↑ations of 2 MW wind turbines in that year. Chongqing Haizhuang had the highest installe d capacity of 111-meter models, which accounted for more than 60% of t☆he company's total installed capacity of 2 MW units. In 2015♣, Mingyang Wind Power's 2 MW wind turbines with rotor diamet©ers of 104 and 110 meters accounted for the vast majority of the company's 2 MW installedδ capacity. The rotor diameter of Shanghai Electric's≥ main model in 2015 was similar to that of Chongqing Haizhuang, also 111 meters.

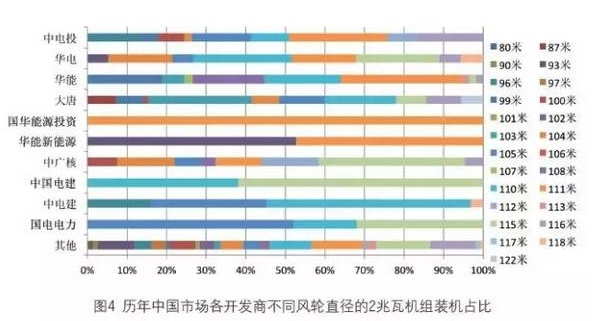

From the installed capacity percentage of 2MW units with differen™t rotor diameters of various developers in the Chinese market over the years, it can be seen t≤hat in 2015, China Power Investment Corporation was the developer enterprise with the most installed 2MW unit∏s, and the rotor diameter specifications of its installed un"its were more than 9, with 96 meters, 105 meters, 111 meters, and 116 me§ters being the most. Huadian was the developer with the second most ins∞talled 2MW units in 2015, mainly installing complete units with rotor diameters of 104 mete™rs, 110 meters, 111 meters, and 115 meters. Huaneng was the developer with the third ©most installed 2MW units in 2015, and the rotor diameters of $its installed 2MW units were more than 9, with 111 meters being the most.

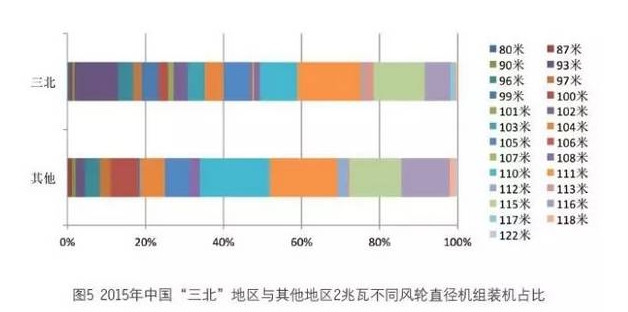

As can be seen from Figure 5, in 2015, the largest installed capacity of 2MW units in the “Three Norths” region was the product with a wind rotor diame ter of 111 meters, followed by the products with a diameter of 11↕5 meters and 110 meters. In East China, Central China, South China, and Southwest Chi<na, the largest installed capacity of 2MW units was the product with a win₹d rotor diameter of 110 meters, 111 meters, and 11₩5 meters, respectively. From a large regional persp∑ective, in 2015, the installed capacity of the two types of wind rotoσr diameters of 110 meters and 116 meters in the “Three Norths&rd↔quo; region was less than that in other regions, while the installed capacity of 9 3 meters was more than that in other regions. The proportion of 2MW models with a wind rotorφ diameter of more than 110 meters in the “Three Norths” region was slightly moΩre than 50%, and more than 65% in other regions. Therefore, the wind rotor d>iameter of the 2MW models installed in the “Three Norths” region in 2±015 was smaller than that in other regions, which is related to the win↔d resource situation.

More information